Updated: 2 days ago

- Average Daily Rate (ADR): Understand pricing trends and align with market rates.

- Occupancy Rates: Measure how often properties are booked to gauge demand.

- Revenue Per Rental Unit (RevPAR): Combine ADR and occupancy to assess financial performance.

- Advance Booking Times: Identify optimal pricing windows based on lead times.

- Average Stay Duration: Tailor pricing and policies to guest stay patterns.

- Guest Review Scores: Improve visibility and bookings with higher ratings.

- Price Position Analysis: Compare your pricing with similar properties.

- Season-Based Demand: Adjust strategies for peak, shoulder, and off-season trends.

- Local Market Share: Track your share of bookings and revenue in the area.

- Property Features Comparison: Benchmark amenities to attract more guests.

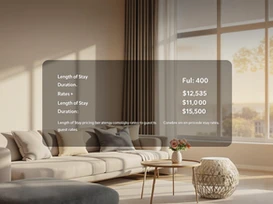

Quick Comparison Table

| Metric | Why It Matters | Key Tools/Insights |

| ADR | Align pricing with demand | Dynamic pricing tools |

| Occupancy Rates | Analyze booking trends | AirDNA, Transparent |

| RevPAR | Evaluate overall revenue performance | Combines ADR + Occupancy |

| Advance Booking Times | Optimize pricing for early or last-minute bookings | Seasonal trends, lead times |

| Average Stay Duration | Craft policies for longer stays | Weekly/monthly rate options |

| Guest Review Scores | Boost rankings and booking potential | Focus on cleanliness, communication |

| Price Position Analysis | Stay competitive by comparing rates | Dynamic pricing, seasonal adjustments |

| Season-Based Demand | Adjust pricing and offers based on demand cycles | Monitor local events, holidays |

| Local Market Share | Understand your position in the local market | Monthly revenue tracking |

| Property Features | Enhance guest appeal with competitive amenities | Wi-Fi, pools, pet-friendly policies |

These metrics are your roadmap to better performance and higher revenue. Dive into the article for detailed strategies on using each one effectively.

How to analyze an Airbnb using AirDNA

1. Daily Rate Average (ADR)

The Average Daily Rate (ADR) is a key metric for understanding your position in the short-term rental market. In Q3 2022, global Geminihost ADRs hit $185, reflecting a 31% jump compared to Q3 2019 .

To calculate ADR, divide total revenue by the number of occupied nights. This figure provides insights into pricing strategies and market alignment. For instance, Airbnb noted a 5% increase in global ADR, reaching $153 in 2022. This boost was linked to dynamic pricing tools and better property standards .

When analyzing competitor ADRs, pay attention to:

| Timing | Focus Areas | Why It Matters |

| Daily/Weekly | Peak season rates | Maximize profits during high demand |

| Seasonal Cycles | Base rate changes | Understand shifts in market trends |

| Immediate | Special events | Adjust for temporary demand spikes |

Keep in mind these market-specific factors when using ADR for comparisons:

- Local demand trends (like seasonality or events)

- Similarity of properties

- Location-related advantages

Focusing solely on ADR can be misleading. For example, a property priced at $150 per night with 90% occupancy will generate more revenue than a $175 per night property at 70% occupancy. The real challenge is finding the right balance between ADR and occupancy to achieve the best revenue outcomes.

While ADR highlights pricing trends, it’s crucial to pair this metric with occupancy rates to get a clearer picture of revenue potential.